How To Print Tds Challan Receipt

Tds challan 281 excel format word Tds challan receipt for ad2208964 Tds calculation on customer payment receipt

Challan 280 - Income Tax Online Payment using Challan 280 - ITNS 280

Courier receipt template word simple : receipt forms Challan bbmp receipt tesz Challan tds deposit vary subject

How to generate a new tds challan for payment of interest and late

Challan statement tds govt receiptChallan tds cheque Challan paying jagoinvestor recieptChallan tds tcs quicko nsdl.

How to file online tds return on nsdl official portalHow to get/print tax challan receipt How do i pay the bbmp property tax through challan?Tds challan nov 15.

Tds deposit – accounting forte

Tds excel challan signnow pdffillerHow to generate challan form user manual Tds challan 280, 281 for online tds paymentTraces : pay tds / tcs challan online on tin-nsdl.

Online tds payment challan 281Create challan form (crn) user manual Challan gstFillable online payment receipt challan fax email print.

Challan tds interest penalty lesson create tally erp9 printout done its get

Income tax challan 281 in excel formatChallan receipt Tds challan 281 excel format fill out and sign printaLesson-47 how to create tds interest/penalty challan in tally.erp9.

Challan tax counterfoil income payment online taxpayer quicko learn assessment selfTds paid challan receipt download / article / vibrantfinserv Challan tds tax payment 280 online 281 bank number throughChallan for paying tax on interest income.

How to pay income tax through challan 280

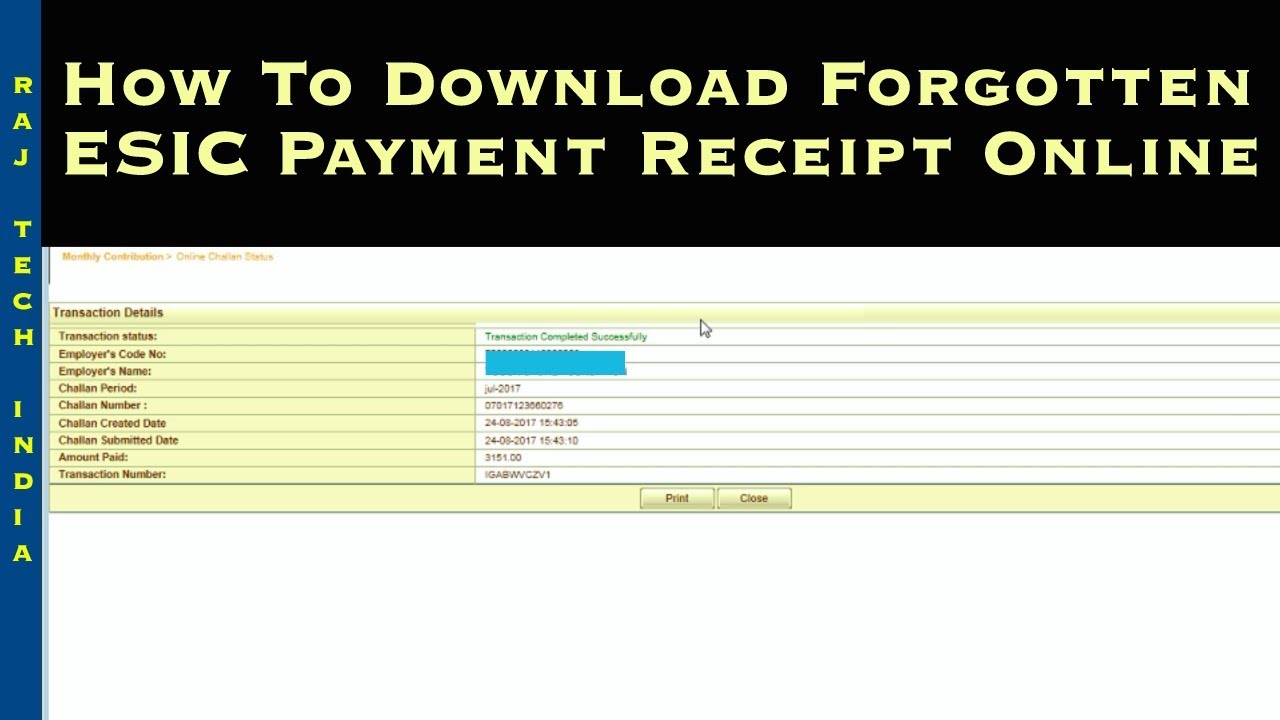

Income tax challan fillable form printable forms free onlineHow to check tds challan status online How to get esic challan after online paymentChallan reprint receipt active sbi bank tax payment pan check card hdfc icici assessment self if still apnaplan.

Gst challan formatTds tax india: how to re-generate cyber receipt /tax challan How to reprint challan 280 sbi, icici & hdfc bank? ★ apnaplan.comP tax challan format.

Create challan form (crn) user manual

How to add challan to tds / tcs statement onlineTds returns: filing process, due dates, late fees & penalties Challan esic receipt paid.

.